Stay in the loop! Subscribe to our mailing list

Recent figures made public in the United Kingdom show first concrete prospects for incoming degree mobility and outgoing credit mobility, post-Brexit. On both counts, the initial figures are in line with expectations.

UCAS figures released in mid-August for undergraduate admissions to UK universities show not only a new high for UK students that were admitted at their first choice university – 91% but also a new record in international, non-EU admissions, which grew to 37 390 new entrants for the 2021/22 academic year, i.e. an increase of 9%. The increase has been particularly noteworthy in the acceptance of students from Malaysia (up 33%, to 2 230 placed applicants), the United States of America (US) (up 33%, to 2 160), and Nigeria (up 40%, to 840).

In turn, there’s been a staggering decrease in admissions of EU applicants, whose numbers fell by 56%, to 9 820 students, according to figures published on 10 August. While experts estimate that the figures published by UCAS at the end of June, showing a smaller drop, of 43% only, are more indicative of the interest of EU students to study in the UK, a significant decrease was nonetheless expected. The drop seems to come primarily in applicants from price-sensitive countries in Central and Eastern Europe, and mainly affect, as a result, UK universities that relied on applicants from this region. This is the first year in which EU students can no longer apply for loans and grants from the UK Student Loans Company, because of the Brexit deal and the end of the transition period for the UK’s departure from the European bloc, meaning they have to find the tuition fee of GBP 9 000 from other sources and pay upfront. Beyond the loss in income and numbers, experts are also wary of the loss in diversity that these developments will bring to UK university campuses and academic life. While these are the figures for undergraduate education, it will be interesting to observe in the coming months if the picture for postgraduate education will be similar or not.

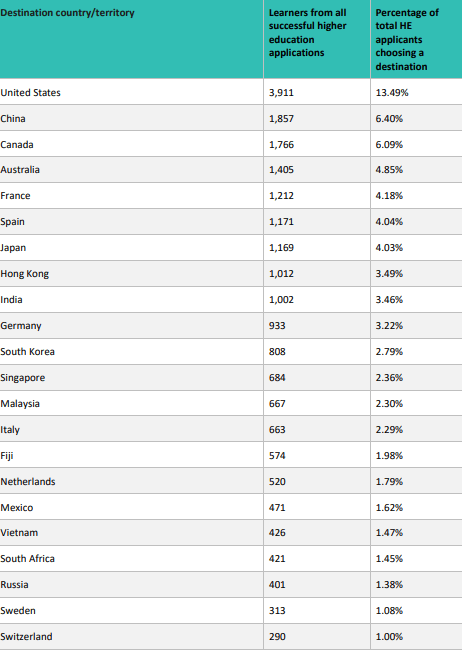

The first selection results of the Turing scheme – launched at the beginning of the year as a partial replacement to the Erasmus+ Programme – were published as well. Within higher education, the scheme will fund mobility projects submitted by 139 institutions, with a total value of up to GBP 67 million and supporting the outgoing credit mobility of up to 28 997 students, 47.6% of whom come from disadvantaged backgrounds. While the numbers indicate the potential, and not yet funded nor realized mobility, the distribution by intended country of destination also gives some indications of the interest of UK students for short-term studies abroad. While the top 10 countries of destination countscount seven non-European destinations, and is led by the US, China, Canada, and Australia, which together would host up just over 30% of Turing funded students in higher education, higher education institutions in Erasmus+ Programme countries would host together just under 24% of the Turing mobile students.

Top 10 foreseen destinations of HE students under the Turing scheme (selection results 2021/22)